Breaking News

The World Trade Center Health Program has just added Uterine Cancer to the List of WTC-Related Health Conditions. Call us to find out if you qualify!

Deadline Extended to Register 9/11 Compensation Claims

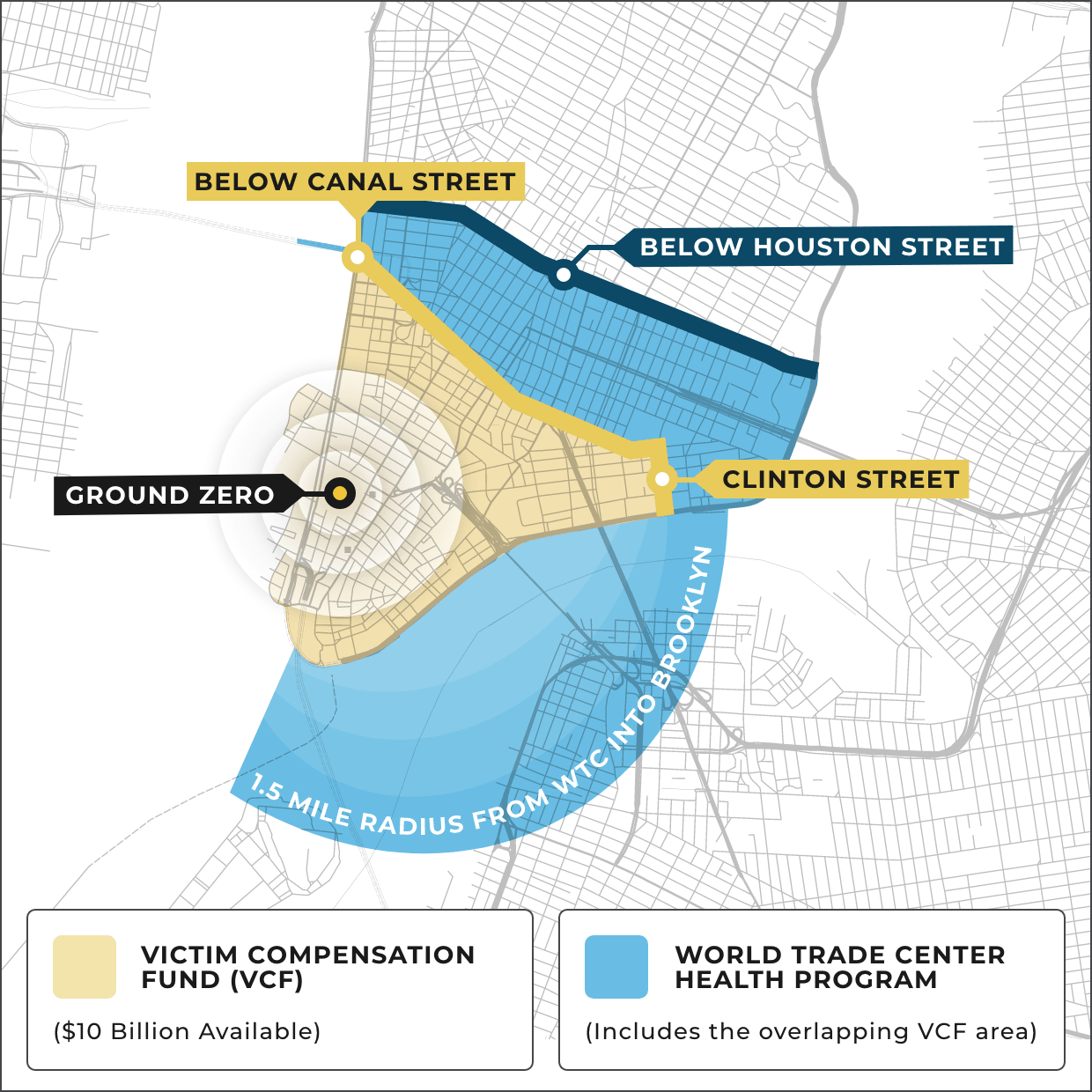

$10 billion and free health care available for responders, construction & debris removal workers, downtown office workers, residents, students & teachers

Submit this form for a free consultation

in the 9/11 community

for victims & their families

get free lifetime health care

The World Trade Center Health Program has just added Uterine Cancer to the List of WTC-Related Health Conditions. Call us to find out if you qualify!

911victims.com℠

$3,700,651for a disabled NYC police officer due to leukemia

$3,254,242for wrongful death of a firefighter due to 9/11-related asthma/RADS

$2,811,150for a disabled sanitation worker due to skin cancer/melanoma

$2,811,150for a disabled stock broker due to multiple myeloma

$2,022,440for wrongful death of Con Edison employee due to liver cancer

$1,731,917for wrongful death of a carpenter due to lung cancer

$1,827,279for a disabled teacher due to breast cancer

$1,812,981for a disabled steel worker due to bladder cancer

$1,422,694for wrongful death of a downtown office worker due to pulmonary fibrosis

Non life-threatening illnesses:

$20,000-$90,000

Skin cancers:

$90,000-$250,000

All life threatening cancers:

$200,000-$340,000

Prior results do not guarantee a similar outcome. Barasch & McGarry, Lawyers for the 9/11 Community is located in New York, New York and serves clients throughout the entire NY metropolitan area, including former New York residents who have since relocated to other states and volunteers who came to NY to help in the WTC rescue and recovery efforts.

Never Forget The Heroes Act passes

Barasch & McGarry was proud to join forces with 9/11 advocates, including comedian Jon Stewart, to successfully lobby Congress for the Permanent Authorization of the September 11th Victim Compensation Fund (VCF).

Don’t Wait:

Compensation is available to anyone who has become sick or died from exposure to the toxins on 9/11. Lower Manhattan Office Workers, Residents, Teachers and Students – not just Responders and Volunteers, are all eligible. Check If You Qualify

New WTC-Linked Cancers added every year

Over 15,000 people in the 9/11 community have been certified with one or more of 69 cancers linked to the toxins. Cancers with long latency periods, such as mesothelioma, are just starting to emerge. Among the 69 cancers, the most common are:

The sooner you act, the sooner you can receive the benefits and compensation you deserve.

Non-Cancer Illnesses Linked to 9/11

If you weren’t caught in the toxic dust cloud that day, you might overlook the connection between your illness and 9/11. Area office workers, residents, teachers, and students should be aware of the most common non-cancerous illnesses linked to the WTC toxic dust:

If you have any questions about your eligibility, take advantage of a free consultation with one of our experienced 9/11 attorneys. Legal fees are 10% and contingent on a successful result.

The World Trade Center Health Program (WTCHP) provides free nationwide health monitoring, testing, treatment, and prescription drugs for people with a range of 9/11-linked conditions. If you were in Lower Manhattan on 9/11 or in the aftermath, you should register now, even if you’re currently healthy.

IN ASSOCIATION WITH 911VICTIMFUND.COM®

With our office just steps from Ground Zero, we witnessed the pain of the 9/11 attacks first-hand. Many in our office have since developed 9/11-related illnesses and some have passed away. We felt the impact that day and continue to feel it today. We will never stop fighting for victims and families in the 9/11 community.

No one has filed more claims with the 9/11 Victim Compensation Fund or helped more people enroll in the free World Trade Center Health Program. You can count on a reliable case assessment and a smooth filing process.

We are the sole law firm that has advocated for the rights of the 9/11 community from the very start making numerous trips to Washington to successfully lobby Congress for all those exposed to the toxic dust from the September 11th attacks.

Fill out the form below or call (917) 636-4661 to get started with your eligibility check and free consultation.

Hi, we are here to help if you have questions.